Hong Kong property stamp duty refers to the taxes that are payable by anyone bought a property in Hong Kong.

There are different types of stamp duty that may apply to property transactions in Hong Kong. These include:

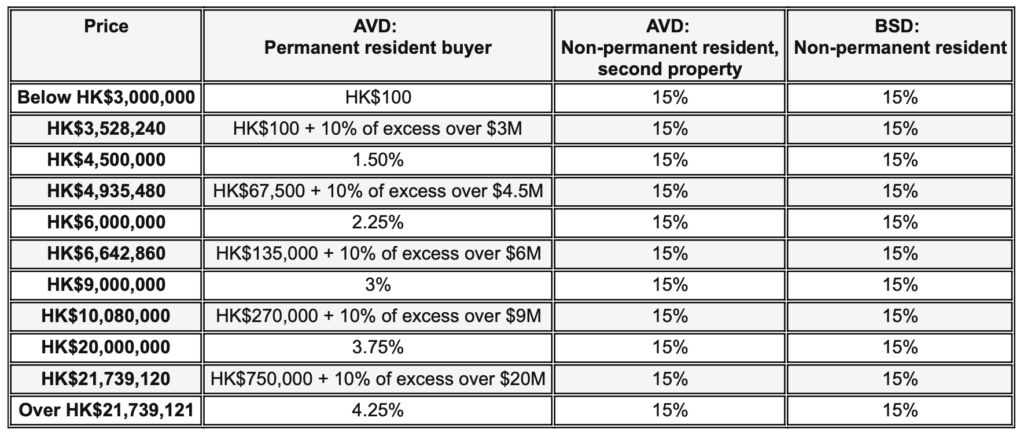

1. Ad Valorem Stamp Duty: This is a tax on the purchase price of the property. The ad valorem stamp duty rates vary depending on the value of the property and the buyer’s status. For example, Hong Kong permanent residents buying their first property are eligible for a lower ad valorem stamp duty rate.

2. Buyer’s Stamp Duty: This is an additional tax on the purchase price of the property, payable by non-Hong Kong permanent residents. It is levied at 15% and is payable in addition to the AVD.

3. Special Stamp Duty: This is a tax on the sale of residential properties that are resold within a certain period. The SSD was created to disincentivise speculating and quick turnover transactions, and so it is paid at the time of sale by the vendor. It is calculated depending on how long the vendor has owned (held) the property:

- Property holding period for 6 months or less – 20% of the sale price

- Property holding period for 6 months to 12 months or less – 15% of the sale price

- Property holding period over 12 months and for 36 months or less – 10% of the sale price

It is important to note that the stamp duty rates and regulations may change over time, so it is always advisable to check the latest information from the Hong Kong government’s website. https://www.gov.hk/en/residents/taxes/stamp/stamp_duty_rates.htm

With effect from 11 am on 22 February 2023, stamp duty on sale of immovable property in Hong Kong is charged at rates which vary with the amount or value of the consideration as follows:

(Where the stamp duty calculated includes a fraction of $1, round-up the duty to the nearest $1.)